There are a lot of new FP&A software tools that promise to automate financial reporting and leverage AI to streamline your business. The reality is the spreadsheet is still the go-to FP&A tool, while other tools are used to augment spreadsheets, streamline reporting, and visualize data.

There are a lot of new FP&A software tools that promise to automate financial reporting and leverage AI to streamline your business. The reality is the spreadsheet is still the go-to FP&A tool, while other tools are used to augment spreadsheets, streamline reporting, and visualize data.

In this guide, we'll explore how to choose an FP&A toolset and review top FP&A tools, including:

- How to choose an FP&A tool set

- Best spreadsheet: Row Zero

- Best BI tool: Power BI

- Best FP&A software: Anaplan

- Why spreadsheets are still core to FP&A

How to choose an FP&A tool set

Choosing an FP&A tool set can be a little overwhelming. A typical FP&A team uses multiple tools, with a spreadsheet being a core tool used across virtually every finance function. Other FP&A tools are used to augment spreadsheets, transfer data, and streamline reporting according to templates and pre-defined metrics. The best FP&A tools for your company will depend on your goals, budget, and two key questions:

1. How big is your data?

This is a critical question because many tools have data limits or get very slow with big data. Excel and Google Sheets in particular, struggle with big data and each has a hard limit - 1,048,576 rows for Excel and 10 million cells / 100 MB for Google Sheets.

Under 10,000 rows

If your datasets are always under 10,000 rows, you'll be able to use just about any tool and legacy spreadsheets like Google Sheets and Excel will take you very far. The primary things you'll want are:

- Tools and templates to track, organize, and automate financial reporting for you

- Spreadsheet add-ons to automate data updates

Above 100,000 rows

If your datasets are consistently above 100,000 rows, you'll need a more powerful spreadsheet like Row Zero, which can handle 1000x bigger datasets than Excel. You may also use a BI tool or purpose-built FP&A tool to work with bigger datasets and then export smaller subsets to Excel or Google Sheets.

If your datasets are between 10,000 and 100,000 rows, you may be able to get by with legacy spreadsheets, but may need more powerful tools as your business grows.

2. Where is your data?

This is a critical question because you want to be able to streamline data transfer between your data sources, your spreadsheets, and other FP&A tools. Eliminating manual downloads and uploads is critical to efficiency, accuracy, and data security.

- Mostly files: If your data is always in CSV or XLSX files, you can simply upload into most tools. If your files are too big for Excel, use Row Zero. Using files has significant drawbacks in terms of efficiency, data integrity, and data security, so if possible you should try to connect to your original source and avoid files. If you must use files, you should create a dynamic where you can update spreadsheets with new files rather than having to rebuild your work.

- A few data sources: If your data is in one or two software tools (e.g. Salesforce) or one data warehouse (e.g. Snowflake) then you'll want to optimize your FP&A tool set for this data source.

- Many data sources: If your data is in many software tools (e.g. Stripe, Quickbooks, and Salesforce), then you'll want a solution that supports data transfer from many sources.

The key is to evaluate what you need to produce on both a recurring and one-off basis. Where does that data live? How big is it? What are the strengths and weaknesses of the tools you're currently using? What's a reasonable budget? From there you can be better prepared to properly evaluate your FP&A tool set.

Best FP&A Tools by Category

Best Spreadsheet

Spreadsheets are a critical tool for financial planning and analysis. The best spreadsheet for you depends on how big your data is and where your data is located.

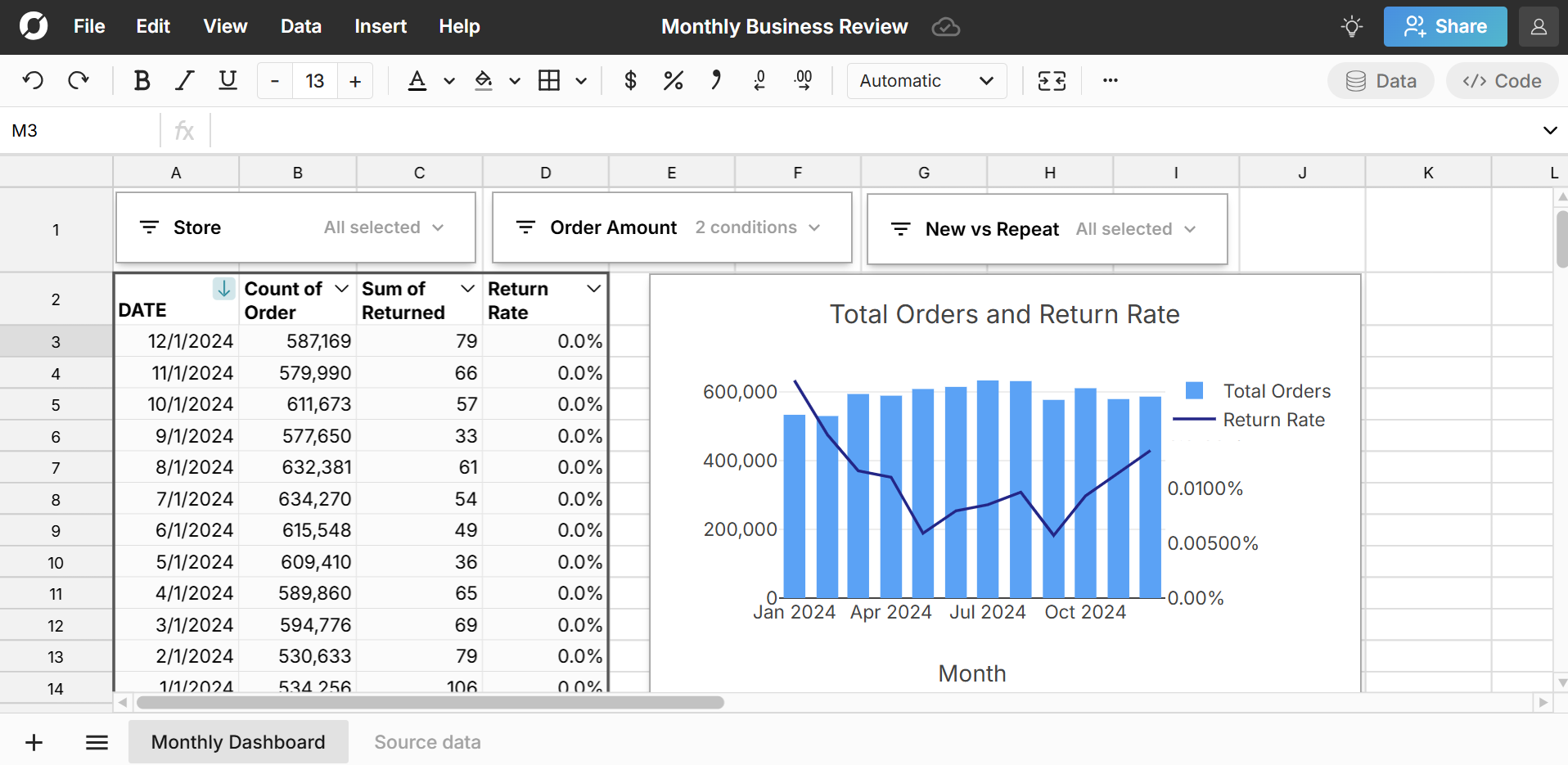

Row Zero is best for big data

Row Zero is an enterprise-grade spreadsheet that is built for big data, security, and cloud connectivity. Enterprise plans support billion row spreadsheets (1000x Excel's limits). You can easily build connected spreadsheets that auto-update including pivot tables, charts, dashboards, etc.

For smaller data, stick to your workspace software

If your datasets are under 10,000 rows you are probably best off staying in your workplace software suite - Google Sheets if you use Google Workspace or Microsoft Excel if you use the Office 365 suite.

Best spreadsheet add-ons

Excel and Google Sheets add-ons can greatly augment your spreadsheet work. The biggest win is from data connectors which can improve spreadsheet efficiency and enable spreadsheet automation.

There are two different flavors:

- Multi-source connectors (e.g. Coefficient, Coupler, etc.)

- Source-specific connectors (e.g. Salesforce, Databricks Connector for Google Sheets)

If you need to connect to many data sources, Coefficient is a popular Excel and Google Sheets add-on that makes it easy to connect to a large variety of data sources. Read our review of Coefficient features.

If you only need to connect to one source, search in the Excel or Google Sheets add-on marketplace for your data source and find the best tool for you.

There are also several FP&A Excel add-ons which provide some of the features of the dedicated FP&A tools integrated into Excel or Google Sheets. These include Vena Solutions, Cube Software, and Datarails.

NOTE: These add-ons all face the same core limits of Excel and Google Sheets, so you'll face limitations or poor performance when working with big data. As a result, this add-on FP&A software is best for small businesses and companies working with smaller datasets.

Best BI tools

Beyond spreadsheets, the best BI tool for financial planning and analysis depends on your needs. Here are a the 3 most popular BI tools:

- Power BI: Power BI is the most widely used and affordable BI tool and is an extension of the Microsoft Office productivity suite, so it is a natural first BI tool to try if you're already using Microsoft Excel or are looking for a low cost solution. Read our Power BI review.

- Tableau: Tableau has best-in-class data visualization features, extensive mapping capabilities, and powerful real-time dashboards, but is more expensive than Power BI. Read our Tableau review or compare Tableau vs Power BI.

- Looker: Looker is good for enterprises using Google Cloud and offers good collaboration and sharing features, but is higher priced compared to other tools.

View our deeper review of top BI tools.

Best financial planning software that is purpose-built

For organizations that want an FP&A tool with more purpose-built financial planning features and templates, there are several FP&A software tools to consider. Similar to the above tools, the best FP&A tool for your org will depend on your data size, needs, and budget. Here are top tools to consider:

1. Anaplan

Anaplan is an "AI-infused scenario planning and analysis platform" and is a popular FP&A software tool for large enterprises with robust modeling, scenario planning, and driver-based forecasts.

Pros:

- Scalable and flexible for complex, enterprise-wide planning

- Supports real-time multi-dimensional modeling

- Strong scenario planning and what-if analysis

- Integrates with popular enterprise systems (ERP, CRM, HRIS)

Cons:

- Significant cost and set up time

- Requires dedicated model builders and has a steep learning curve

- May be overkill for small to mid-sized companies.

Best for: Large enterprises with complex modeling needs and cross-functional planning requirements and when the finance team has dedicated IT or finops resources.

2. Pigment

Pigment is a "unified enterprise platform" used by finance, sales, and HR teams and is a newer alternative to Anaplan.

Pros:

- Modern UX with powerful multidimensional modeling

- Real-time collaboration, audit trails, and scenario planning

- Excel-like formulas

- Can model sales, HR, and finance together

Cons:

- Still maturing compared to older players like Anaplan.

- Smaller implementation ecosystem than Anaplan or Workday.

- Requires some ramp-up for business users.

Best for: Mid-size to large companies that want a modern, flexible alternative to Anaplan. Pigment is good for cross-functional teams doing strategic planning across the org.

3. Workday Adaptive Planning (formerly Adaptive Insights)

Workday Adaptive Planning is a cloud-based enterprise performance management (EPM) software that powers financial planning, budgeting, forecasting, and reporting for enterprises.

Pros:

- Intuitive, Excel-like UI

- Strong in budgeting, forecasting, and workforce planning

- Good collaboration features and real-time dashboards

- Cloud-native, integrates well with Workday and other popular ERPs.

Cons:

- Less flexible for highly customized models or non-financial planning

- Limited advanced analytics compared to tools like Anaplan or Pigment

- Pricing can be high for mid-market companies

Best for: Mid to large organizations already using Workday or seeking easy-to-use, cloud-based FP&A solutions with solid planning features.

4. Planful (formerly Host Analytics)

Planful is a Financial Performance Management (FPM) platform that powers financial planning, budgeting, forecasting, and reporting.

Pros:

- End-to-end FP&A platform: budgeting, planning, consolidation, reporting

- Designed for finance-led implementations with low IT dependence

- Built-in connectors to Excel and Google Sheets, SaaS tools like Salesforce and Quickbooks, and ERP systems like Oracle, Sage, SAP, etc.

- Straightforward user interface with guided workflows

Cons:

- Less flexible for highly customized planning use cases.

- User interface may feel a bit dated compared to newer competitors.

- May experience performance lags with large datasets compared to bigger competitors.

Best for: Mid-market companies looking to streamline FP&A processes without needing large IT support.

If you're looking for purpose-built FP&A software for small business use cases, consider trying a spreadsheet add-on mentioned above.

Why spreadsheets are still core to financial planning

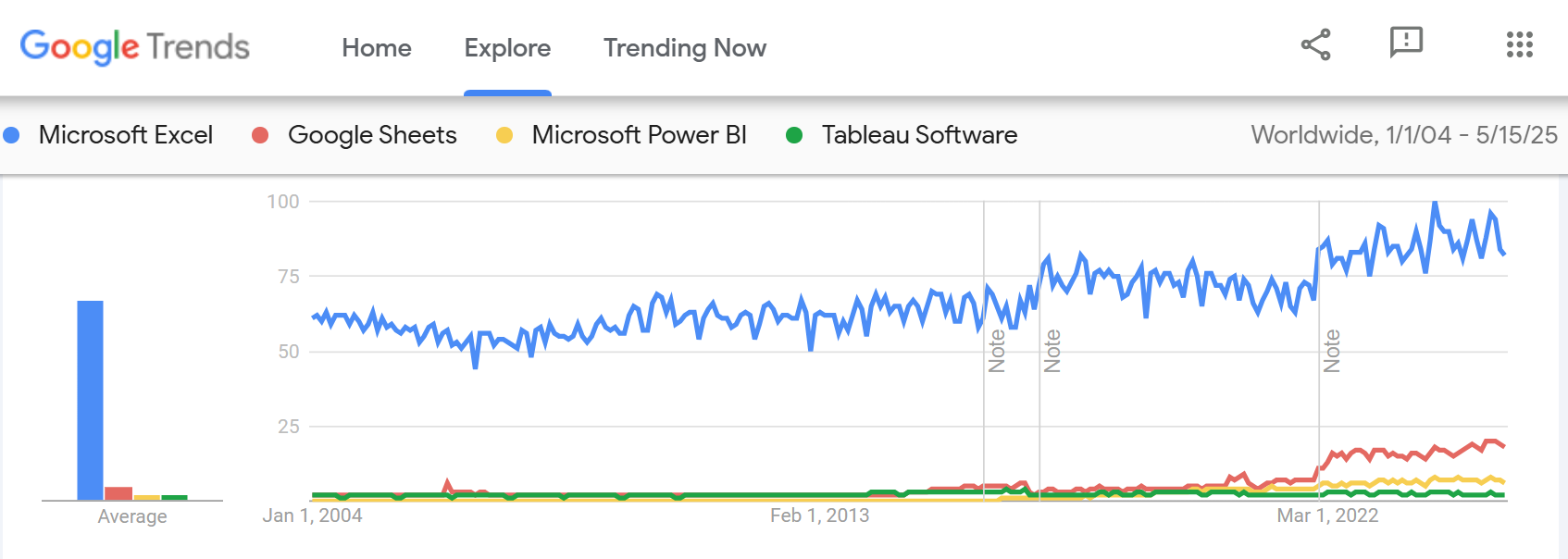

Despite the rise of BI tools and dedicated FP&A software, spreadsheets continue to be the go-to tool for finance and business teams and are as popular as ever, according to Google Trends.

Many BI tools and FP&A solutions emerged due to two key limitations of legacy spreadsheets:

- Data size limits: Excel has a row limit of 1,048,576 and Google Sheets has similar limits

- Lack of connectivity to cloud data tools (e.g. Salesforce, Snowflake, etc.)

While BI and FP&A tools are used to aggregate and visualize the data, it's common for finance professionals to export to CSV from these tools to continue working in a spreadsheet. In some ways, these tools have just added another layer of cost and overhead to working in spreadsheets.

To address the limitations of legacy spreadsheets, modern spreadsheets, like Row Zero, have emerged that offer the big data power of BI tools and built-in cloud connectivity to popular data sources (Snowflake, Databricks, Oracle, BigQuery, etc.).

In addition, legacy spreadsheets like Excel and Google Sheets now have robust add-on marketplaces that make it more possible to connect to popular data sources. There is even an ecosystem of FP&A add-ons for Excel and Google Sheets.

As spreadsheets evolve to solve big data and connectivity needs, they continue to be the go-to FP&A tool for most financial planning analysts and finance leaders.

Conclusion

If you can only pick one tool for financial planning and analysis, spreadsheets are still number one for most FP&A teams. Despite the myriad of sophisticated BI tools and dedicated FP&A software, the reality is data isn't perfect and at some point finance and accounting teams need to work with raw data in a spreadsheet to troubleshoot issues, clean up data, or support ad-hoc modeling and forecasting. A whole class of BI tools and FP&A tools evolved due to the data size limitations of Excel and Google Sheets. Top FP&A software for enterprises includes Anaplan, Pigment, and Workday Adaptive Planning. The best FP&A software for small businesses and startups veer more towards Excel add-ons. Row Zero has emerged as an enterprise-grade spreadsheet that solves the data limitations of legacy spreadsheets and is a powerful tool for FP&A teams.